MANAGING YOUR MONEY

GIVE YOURSELF THE BENEFITS OF BANKING

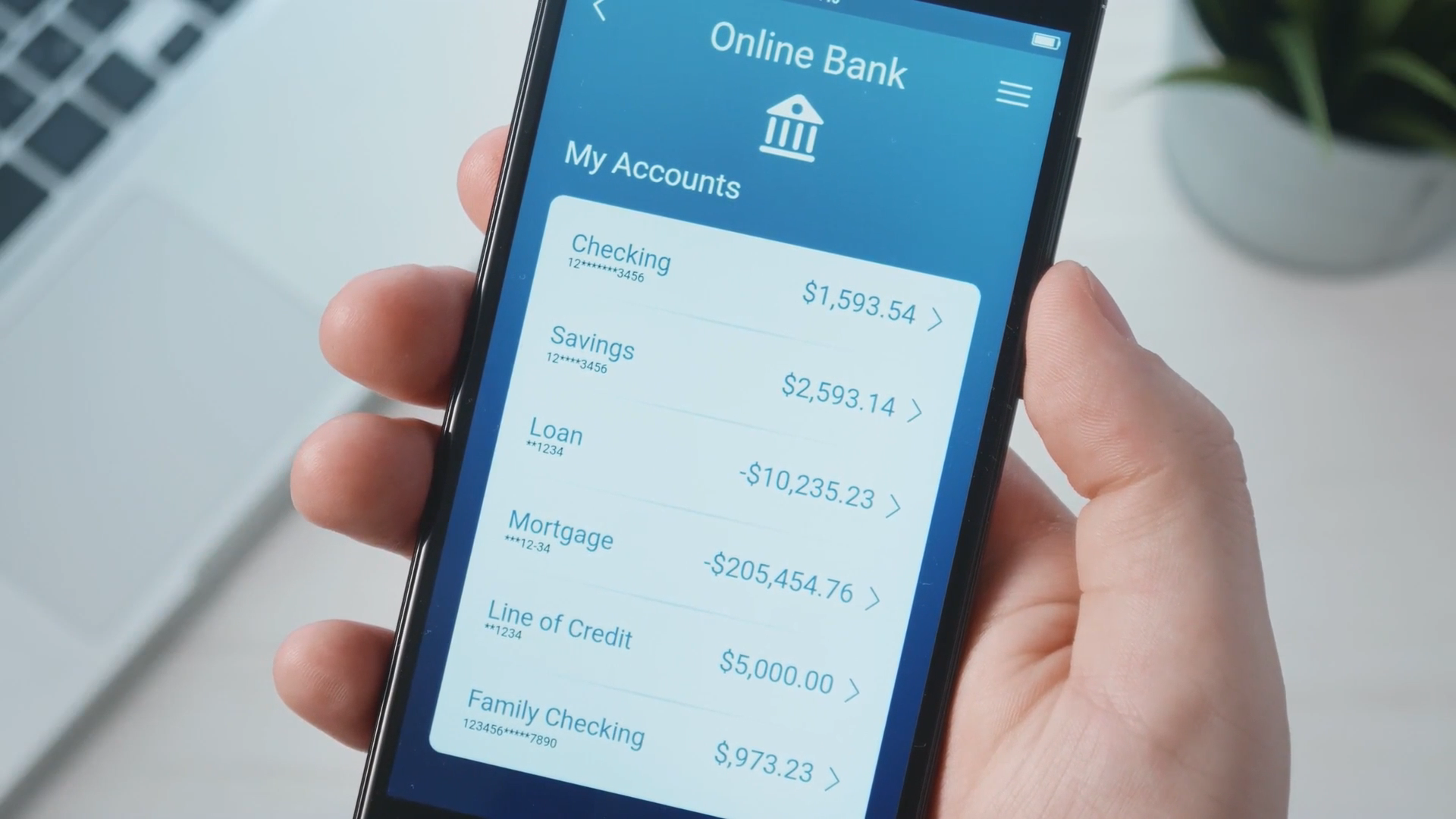

Today’s banks offer so many ways to manage your money. Online and ATM convenience makes it easier than ever to perfect your saving and spending habits. So choose the accounts that work best for you, and let’s get started!

PAY YOURSELF FIRST

THINK OF TOMORROW’S GOALS AS TODAY’S EXPENSES

Do you have a part-time job? Get an allowance? Receive cash for birthdays and holidays? Probably the first thing you want to do when you get money is spend it. But that jumbo popcorn and soda combo Friday night is not going to get you any closer to paying for next month’s concert tickets. You need to make saving for your short- and long-term purchase plans Priority One. Think of saving as an expense you must pay, and make a deposit first, every time you receive money. You’ll be surprised to see you barely miss the extra cash. And you’ll be delighted to see how quickly your money grows in your savings account. How much money should you pay yourself? You can’t answer that until you know what your expenses are. And the best way to determine that is by creating a simple budget. Once you know what other financial obligations you have, you can go ahead and pay yourself first.

WHY BANKS OFFER INTEREST

AS YOUR SAVINGS GROW SO DOES YOUR BANK

Chances are you already have a savings account, so you know it’s a convenient and safe place to keep your money. It’s also a smart place, because banks pay you interest for keeping your money there. Banks provide this incentive in order to grow. Savings that are deposited in the bank’s care are used for loans other customers may need for autos, mortgages, college or other expenses. The interest the bank charges for loans is greater than the interest it pays savers, so the banks can profit as they help you (and borrowers) reach financial goals. That’s a win-win-win situation. And it gets even better for you, because most banks will also pay you interest on the interest your savings earn. That’s called compound interest, which we explain in the next section.

Need to make a withdrawal? No worries – your money will always be there when you need it. Your savings are protected by the federal government, with FDIC insurance for up to $250,000.

COMPOUND INTEREST

NOW THINGS GET REALLY INTEREST-ING

There are two kinds of interest banks may offer savers:

- Simple Interest – based on a small percentage of the money you deposit

- Compound Interest – based on your deposits plus the interest you have also earned

Compound interest is a powerful saving tool, because it does all the work for you. Even if you never make another deposit, your savings will grow. There are two factors that affect compounding: time and treasure. The longer you keep money in the bank (time) the more its interest is compounded. And the larger your savings (treasure) the greater the amount of compound interest it earns.

But what if you have a really big savings goal – such as one million dollars. How long would it take for compound interest to help you save that much? A lot quicker than you might think, depending on how much you can save each month, and on your interest rate. Check it out on the ‘Who Wants to be a Millionaire’ chart in the Know More section.

THE RULE OF 72

DOUBLE YOUR SAVINGS THROUGH INTEREST ALONE

The great genius Albert Einstein called compound interest “the most powerful force in the universe.” In fact, Professor Einstein developed a way to calculate just how fast you can double your savings, through compound interest alone. Here’s how it works: simply divide the number 72 by the annual interest rate of your savings. For instance, $400 at 3% interest would take 24 years to become $800. The higher the interest rate, the faster your savings double – without you depositing a single dollar. Pure genius! And savings grow even faster when you make regular deposits.

SAVING YOUR MONEY

BENEFITS YOU CAN BANK ON

Whether you have an account with a brick and mortar bank branch, or do all your banking online, every financial institution needs deposits in order to make loans and grow. The longer they have use of savers’ money, the more interest they are willing to pay them. So banks offer a range of savings account types, with different features, terms and interest rates. Here are the most popular types of savings instruments:

- Traditional Savings Account – Good for short and long-term savings. You earn interest on deposits, and there are no minimum deposit requirements. You have instant access to your money by making a withdrawal at any time. Your savings account may have a passbook, or you may receive a statement in the mail each month. Many savings accounts come with a debit card, which gives you the added convenience of ATM usage.

- Money Market Deposit Accounts (MMDAs) – Better for long-term savings. Banks offer higher interest rates on these accounts, because they expect you to keep your savings relatively untouched. You are usually limited to six withdrawals per month, and you may be charged a service fee if you don’t keep a minimum amount on deposit.

- Certificates of Deposit (CDs) – Best for long-term savings. When you open this account you agree to leave your money untouched for a specific length of time. In return the bank offers you a higher rate of interest than on other accounts. CDs can offer terms of three months up to six years, at a locked-in interest rate. The longer your term, the higher your interest rate may be. But there is usually a sizeable penalty if you withdraw money before your CD’s maturity date.

KEEPING THE RECORDS STRAIGHT

GET THE KNACK OF TRACKING

Good finance is built around knowing how much comes in and how much goes out. Careful recordkeeping is not only your responsibility, it’s in your best interest. Bounced checks and overdrawn accounts can hurt your wallet and your credit rating. You can sign up for overdraft protection, or limit yourself to using prepaid debit cards. But your best way to avoid overdrafts is by taking control of your account. Be vigilant about notating each check and every single ATM use. Keep a current balance, so you know at all times how much is in your account. You can master that skill with a little practice. Try it right now, with the checkbook register and check-writing how-to guides in the Know More section.

PAYING FOR PURCHASES

ACCOUNTS WORTH CHECKING INTO

Debit cards and ATM cards are rapidly replacing checks for daily transactions. We’ll discuss them in the credit section. But although lots of teens consider them old-fashioned, the fact is a checking account gives you practical, hands-on experience with managing your financial life. Checking accounts are a safe and convenient way to buy stuff, pay bills, and eliminate the risk of carrying lots of cash around. The convenience comes with responsibility though: you must keep track of all your transactions, always know your account balance, and never write a check for more money than you have in your account. To do so will incur penalty fees for each ‘bounced check’ and may also hurt your credit rating.

- Basic Checking Account – Good for everyday money management. You can deposit or withdraw money at any time, and can access cash by writing a check or by using a linked debit or ATM card. There are usually no minimum deposit or balance requirements, and if you shop around you can probably find an account with no monthly or check processing fees.

- Interest-Bearing Checking Accounts – If you think you can maintain higher balances, this type of account offers extra perks. The larger your balance, the higher the interest rate you receive. But remember, if you fall below the minimum required balance, you may be charged penalty fees.

- Student Checking Accounts – These teen-friendly accounts feature low balance requirements, fewer fees, plus debit card and online banking convenience. Just make sure your account has no strings attached, such as direct deposit or minimum activity requirements, or the need to enroll in other programs such as overdraft protection.

KNOW MORE

The more you know, the farther you will go! Continue the learning with these resources:

Federal Trade Commission – Budgeting information

www.consumer.gov

• Create Your Budget (budget worksheet)

• Write a Check (write a check)

• Balance Your Checkbook (check register)

• How Long Until You’re a Millionaire? (chart)

Compound Interest Calculator:

www.investor.gov | www.moneychimp.com | www.thecalculatorsite.com

Saving Goal Calculator:

www.moneysmart.gove.au/tools-and-resources/calculator.com

Rule of 72 Calculator:

www.themint.org/kids/power-of-72.html